Should you get an Insurance Savings Plan?

insurance savings plan

Should you get an Insurance Savings Plan?

Insurance Savings plans are popular options that many Malaysians have. I discovered this last weekend when I conducted a 3-day Free Policy Maximisation Rate (PMR) webinar for about 150 people over Zoom. It was a very beneficial session as many participants looked closely at their insurance policy and understood what it covered for the first time.

At the end of the 3-day session, the participants were more financially literate and learned strategies which saved them on their insurance premiums while increasing their coverage, thus optimising their policy.

After the session, I wondered why many participants had insurance savings plans. Then, it hit me. Since I was previously an insurance agent myself, I know selling insurance savings plan are the fastest way to earn a higher commission. Therefore, there is more motivation for agents to sell insurance savings plans. Moreover, selling a savings plan requires less servicing in the future if a claim happens.

Besides that, customers welcome such a plan as there will be a surrender value at the end of the policy. They feel that the premium they are paying is not wasted as they can get all their money plus some additional returns at the end of the policy. Many also purchase insurance savings plans as a retirement fund as the plan gives out yearly payouts.

But, is insurance savings plan a good instrument to save and invest your money?

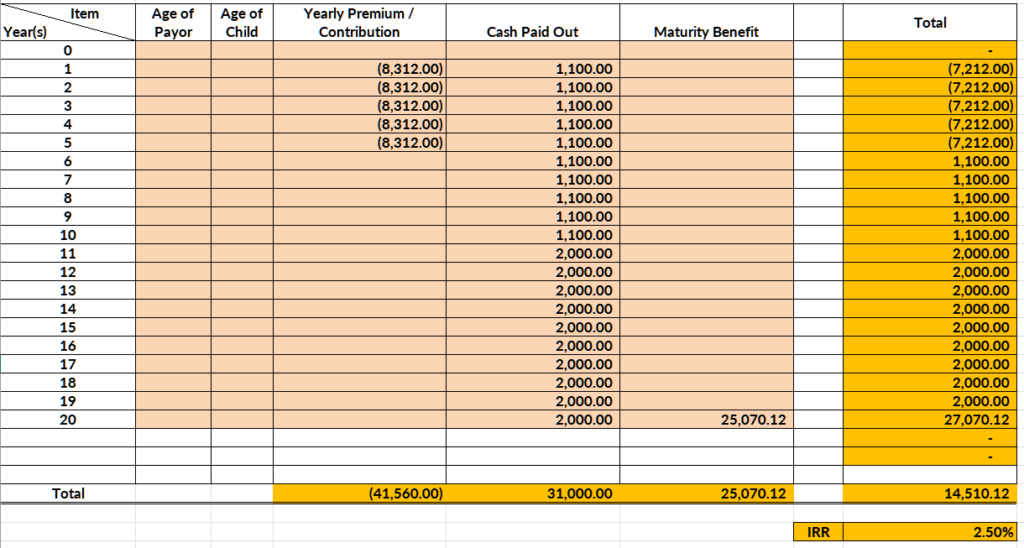

As usual, let’s look at the numbers. I have gotten an example from an insurance savings plan brochure for this case study.

Let’s breakdown the details:

- The plan is for 20 years

- You only pay RM10,00 per year for 5 years, so a total of RM50,000

- From year 1 to year 10, you will get a cash payout of RM1,100/year; a total of RM11,000 over 10 years

- From year 11 to year 20, you will get a cash payout RM2000/year; a total of RM20,000 over 10 years

So at the end of 20 years, you would have gotten RM11,000 plus RM20,000 = RM31,000, but you paid RM50,000. Isn’t that a bad deal?

But wait, at the end of year 20, you will get a lump sum of RM21,500, making the total RM31,000 plus RM21,500 = RM52,500.

Well, now that’s a 5% return over 20 years, right? You get a 5% return, and you get insurance coverage at the same time. Not a bad deal, or is it?

When calculating such returns, we always forget to factor in the time value of money. Simply put, the time value of money means a Ringgit now is worth more than a Ringgit in the future. Therefore to calculate the true returns of the policy, you have to use the Internal Rate of Returns (IRR) calculator.

Based on the IRR calculations:

You will get a return of 0.40% at the end of year 20 ! So is it still a good deal? You can get better returns by saving money in FD or contributing to your SSPN and KWSP.

Perhaps you might wonder, you are getting insurance coverage in addition to yearly cash payments and a lump sum payment at the end of 20 years. So even though the returns are low, your money is not burned while getting coverage.

Again, let’s look at the numbers.

Based on the brochure, this is an estimation of the coverage that you will get over the 20 years:

In comparison, by taking the maximum death coverage of RM50,000 from the above graph, a pure-term life policy with an RM50,000 death benefit for every year will cost you only RM 8440 for the entire 20-year period (Male, age 35, non-smoker as in the brochure).

So, should you get an Insurance Savings Plan?

Let’s say you have taken the term-life option instead of the insurance savings plan, with the same goal to save and get coverage with the same budget.

Budget: RM50,000

Cost of Term-life insurance over 20 years: RM8440

Balance to save: RM50,000 – RM8440 = RM41,560

Savings per year: RM 41,560/5 years = RM8312/year over 5 years

Total returns at year 20 in FD with 2.3% per year return: RM62,612.56 compared to RM52,500 with the insurance savings plan

By saving in FD and getting a term-life policy, you get more coverage (RM50,000 for every year) and higher returns at the end of 20 years.

Also, if you want a similar yearly cash payout like the insurance savings plan, you can do the same by withdrawing the cash paid out every year from the FD and still have a balance of RM 25,070.12 at the end of the year 20 compared to RM 21,500 with the insurance savings plan.

Therefore, I hope this case study helps to illustrate that we should always separate our insurance and investment needs. Insurance should be used purely as a risk mitigation instrument, not as an investment.

Also, do not calculate the absolute returns of an investment but calculate the IRR to factor in the time value of money.

Do you have a savings plan? Look into the policy and calculate your IRR today. Reply to me whether you are happy with the returns and coverage.

*DISCLAIMER – All strategies listed here are not a recommendation or advice. The article is written purely for the purpose of education and journaling only. The content of this article is an expression of my opinion and should not be taken as professional advice. If you are seeking professional advice, please consult me personally. You should do your own research and/or seek an expert’s advice when reviewing your own insurance policy.