How to save 50% of your housing loan interest in half the time

How to save 50% of your housing loan interest in half the time?

How to save 50% of your housing loan interest in half the time

I approached one of my couple clients, Chris (the husband & not his real name) & I told them that I was helping my other clients save on their housing loan interest, I ask them whether they would like me to help them. Here is how I started the conversation with a question “Would you like to buy an AUDI T.T for free after you settle your housing loan?”. They were very curious and our conversation went on like this. (This is an article I wrote in 2015 and is re-posted & re-edited.)

How to buy an AUDI T.T for free after you settle your housing loan?

Chris: “Is this a scam or what? Are you trying to sell me something?”

Me: “Neither”

Chris: “I’m itching to buy an Audi T.T & I’m not sure if this is a good time”

Me: “I could help you buy your AUDI T.T for free after I help you settled your housing loan”

Chris: “How is it possible?”

Me: “Let me show you”

Chris: ‘Sure or not? I’m quite sceptical’

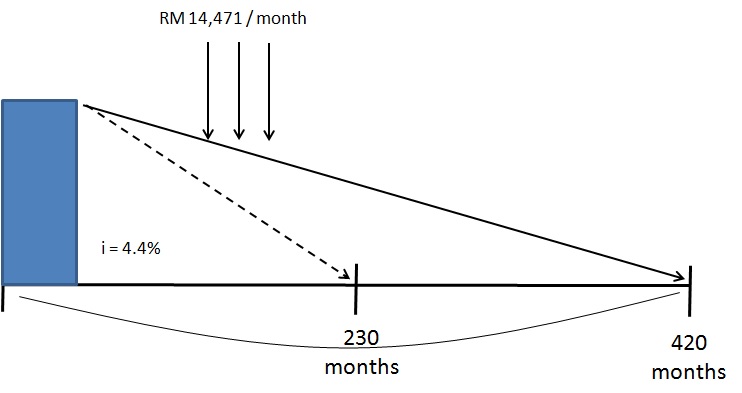

This was how their housing loan look like :

- Property purchase price RM 2.5 Mil (semi-D in Petaling Jaya area)

- Loan Interest Rate was 4.4%

- Loan Tenure (no of years to repay back the loan) was 35 years (420 months)

- Loan Installment is RM 10,471/month

- Total Interest Paid for the whole duration was RM 2,147,808

After my housing loan interest saving advice,

- Total Interest Paid is RM 1,068,815, which is a 50% reduction in interest paid.

- They finish paying off their loan in 19 years & 2 months (230 months), which is 45% earlier (15 years & 10 months OR 190 months).

- He could buy 3 new AUDI T.T worth RM 285,000 with interest savings. (Of course, AUDI T.T’s price would have gone up, but still, if he did not apply this strategy, imagine the 3 AUDI T.Ts the bank managers would have driven off with)

Can you guess what did I suggest to him to do?

- Save an additional instalment of RM 4,000/month into his housing loan

- Ensure their Debt Payment Ratio is still on a Healthy Level (<35%)

- Ensure their Total Saving Ratio is Healthy (>33%) & their net worth is still growing

This was what I suggested he do.

Because they are ‘SAVERS’ (people who like to save money in their bank account), they could channel some of their monthly savings into paying off their housing loans. But one has to take note to maintain a balanced lifestyle of not over-saving as you do not want to lose out on any investment opportunity. Here, it shows how big of a difference it makes over time

- Save an extra of RM 4,000/month on their housing loan, making the instalment RM 14,471/month. Here you can deposit the extra RM 4,000 into a Current Account facility provided by most Malaysian banks by now, which can be used to withdraw later (in the event of emergency)

- Currently their Debt Payment Ratio is only 27% & they can commit up to 35%. Debt Payment Ratio measures how much income is used to pay ALL Loans (housing loan + car loan + personal loan & etc) divided by your NET INCOME (Your Gross Salary net off EPF, Socso, EIS & PCB) Since they don’t have any car loan, personal loan or any other loan, then all their funds can be channel to housing loan.

- By doing (1), they are able to save almost RM 56,551/year in housing loan interest (Total savings on housing loan interest = RM1,078,993)

- The amazing thing of ‘Saving’ the extra RM 4,000/month actually improves their networth. You don’t actually ‘spend’ it, here is how it works

5. Interestingly, RM 3,731.25 of your RM 4,000 goes directly to pay off your principal. So it seems like you were forced to save in your bank account, is just a different account call a loan account

He calls off his purchase & postpones his booking

After I have shown them the above, he called off his purchase of his Audi T.T & redirect his savings to his housing loan. Postponing his purchase after he settled off his housing loan first, he is convinced the savings from the housing loan interest will be able to buy him a free Audi T.T

Do take note that you should only do this for a property that you live in. For property investment, you may not want to use this strategy. Talk to your financial planner or consult me HERE for tailored advice specific to your situation. If you are looking to save on your housing loan interest, be sure to read my other blog “Is Housing Loan Refinancing the only solution in saving interest?”

*DISCLAIMER – All strategies listed here are not a recommendation nor advise. The article is written purely for the purpose of education and journaling only. The content of this article is an expression of my opinion and should not be taken as a professional advise. If you are seeking professional advise, please consult me personally . You should do your own research and/or seek an expert’s advice when overcoming your debt circumstances.